India Pips North America To Become The Biggest Smartwatch Market

India overtook North America to take the top spot in the smartwatch market in the quarter ending in September, according to a report by marketing firm Counterpoint. Festival sales and distribution of affordable smart watches drove the domestic market to grow by 171% year on year.

According to Hong Kong-based Counterpoint, affordable smartwatch models with larger screens and additional features like Bluetooth connectivity were the main drivers of sales in India at the festival.

“Indian brands are expanding their portfolio of affordable products and focus on local manufacturing is also driving growth,” said Anshiki Jain, Analyst at Counterpoint.

Bluetooth calling has become an important feature, accounting for 58% of all shipments, the highest percentage to date. Consumers also prefer larger screens, as evidenced by the fact that 1.5- and 1.69-inch screens accounted for more than half of all shipments in the third quarter.

North America, the leading market from the fourth quarter of 2020 to the second quarter of 2022, grew 21 percent year-on-year, while China and Europe experienced negative growth.

Growth in India means that the country's leading brand, Noise, ranks third in the overall shipments chart, thanks to 218% year-over-year growth, behind only Apple and Samsung.

The smartwatch maker told TechCrunch that it plans to increase domestic production from 50% to 80% by the end of the year. Domestic competitor Fire-Boltt, second only to Noise in terms of market share, ranked fourth globally.

Apple grew by 48% thanks to the impressive sales of the new Apple Watch 8 series, which accounted for 56% of all sales. Samsung grew 6% year-over-year, despite increasing shipments 62% sequentially.

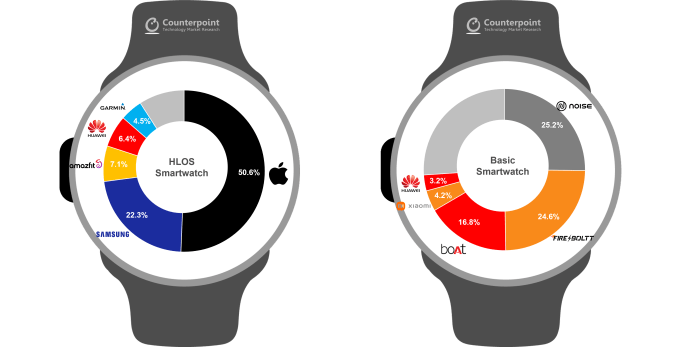

The Counterpoint report divides smartwatches into two categories: smartwatches with an advanced operating system (HLOS), which includes devices from companies like Apple, Samsung, Huawei, Garmin, and Amazfit; and "basic" smartwatches with lighter and cheaper operating systems. Noise, Fire-Bolt, and Boat fall into the latter category.

The think tank reported that the HLOS segment grew by 23%, while the flagship smartwatches doubled, capturing 35% of the market share. Apple currently dominates the HLOS market with a market share of 50%, followed by Samsung.

Image credit: Argument Against

“This strong growth in shipments of leading smartwatches shows us that the market base is rapidly expanding into more affordable segments amid severe supply pressures. However, in terms of revenue, HLOS smartwatches outperformed leading smartwatches by nearly 10 times the market, average Sales due to Woojin So.

Earlier this month, analyst firm IDC published a report on the Indian wearables market, noting that the smartwatch segment grew by 178%, with more than 12 million units shipped in the quarter ending in September. The report said that this increase can also be attributed to the decline in smartwatch prices in the region, with the average selling price (ASP) dropping from $60 to $41.9 annually. IDC says the ASP for a basic smartwatch is $27.5, compared to the ASP for a high-end smartwatch of $330. This indicates that Indian consumers prefer cheaper alternatives to the Apple Watch or Samsung Galaxy Watch.

All Indian smartwatch manufacturers have pledged to rapidly increase domestic production in the coming months to boost production rates. This could help them lower the price of the device and increase shipments with Samsung and Apple.

Post a Comment for "India Pips North America To Become The Biggest Smartwatch Market"